Financing Systemic Transformation

In 2023 the FEST community agreed upon four qualities that define financing systemic transformation:

- Resolute commitment to systems change and transformation, rather than modest adjustments to conventional systems.

- A shared vision of the transformational direction of holistically focus on societal and natural environmental flourishing and well-being that includes values of equity and human-nature harmony.

- Allocating investment to develop and amplify the relationships among actions/projects to realize the scale, scope and complexity of the systemic transformations.

- Organizing financing systems, rather than just a fund, or pipeline innovations, or new measurement approaches, or new capacities. The entrepreneurs are developing all of these elements and the relationships between them to catalyze comprehensive new systems that supersede innovations within the convention financing system. (See: Financing Ecosystems for Systemic Transformation.)

Background

FEST’s mission is to greatly accelerate development of the field of financing systemic transformation (FST). The home page includes some of the key documents that contribute to the definition of financing of systemic transformation, in contrast to other financing. FEST’s definition aims to synthesize leading perspectives.

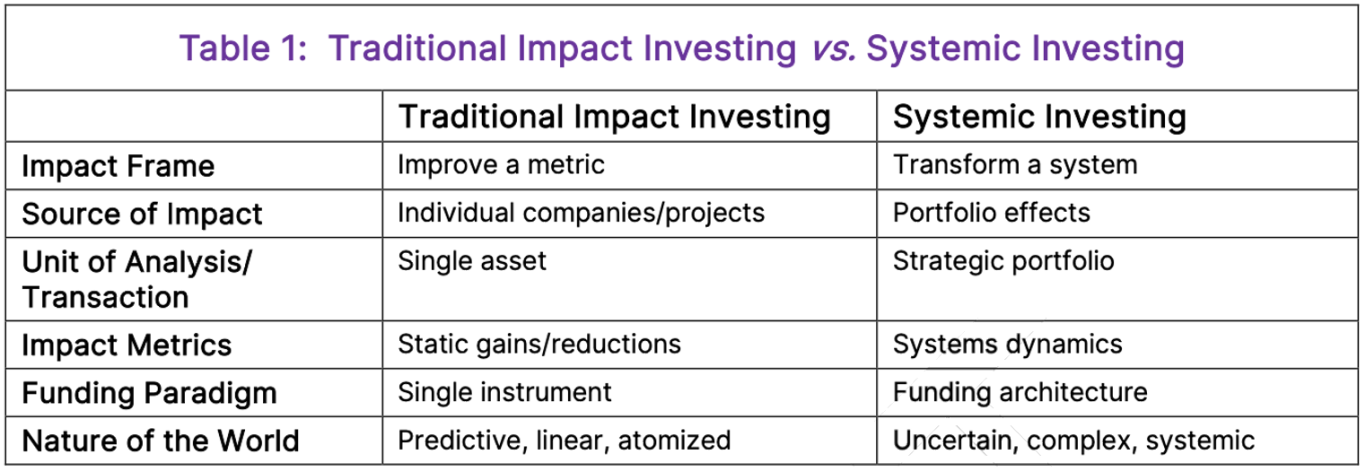

Table 1 grew out of the European initiative Climate-KIC with leadership of Dominic Hofstetter (now lead at the TransCap Initiative). “Systemic Investing” is the approach “so that money can be a transformative force…” (i) TransCap Initiative describes systemic investing as “the application of systems thinking and complex systems science to understanding societal problems and addressing them through the strategic deployment of diverse forms of financial capital nested within a broader systems change program for the purpose of transforming human and natural systems.” (ii)

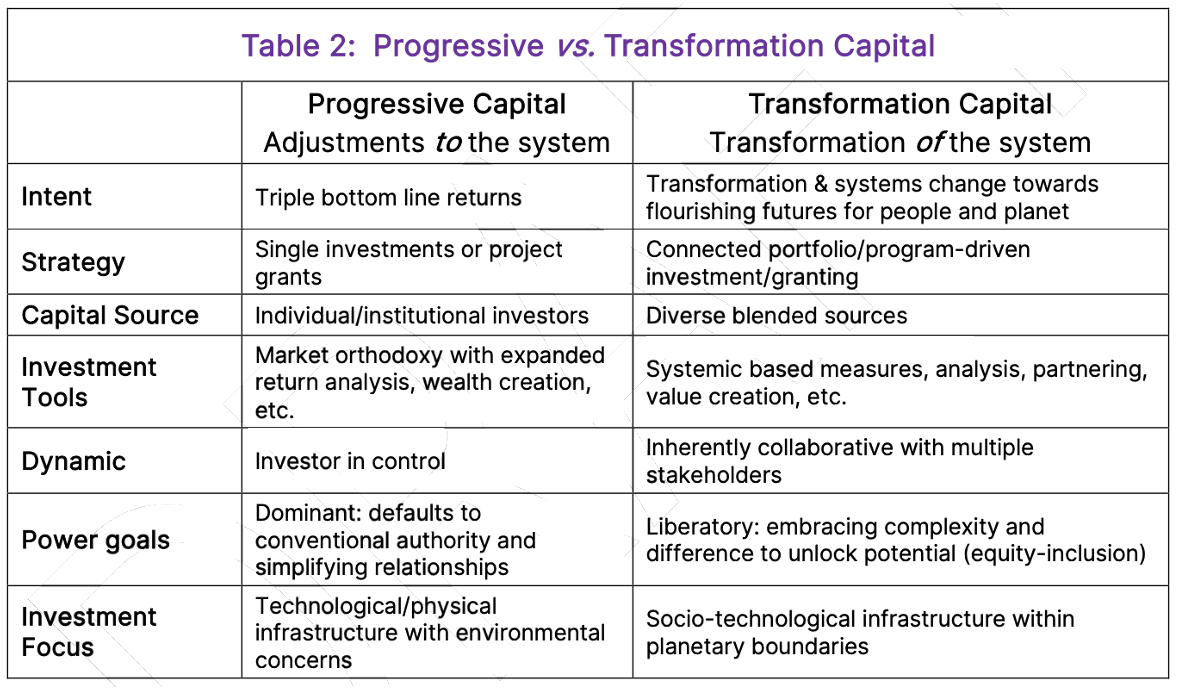

Table 2 (iii) arose from the work of the predecessor of FEST, Working Group 11 of Catalyst 2030.

There is a lot of alignment in these two tables. Notably, they distinguish themselves from the broader field of “impact investing”. From the point of view of that tradition, “Systemic Investing” and “Progressive Capital might be seen as “subsets” of impact investing. However, they can also be seen as encompassing all types of financing, with the proposition that all types are necessary to realize systemic transformation (see: Three Types of Systems Change Finance). The first Table describes the type of finance by its process – systemic investing – that it theorizes will lead to transformation. The second table describes the type of investing by its outcome: transformation. The second Table also categorically brings out the issue of power, whereas it is implicit in the first Table. As well, the second table was seen as one element in defining the transformation finance approach: a second is the importance of evolution of financial ecosystems for systemic transformation (see the Core Concept: Financial Ecosystems for Systemic Transformation).

A look at “systems capital” from a design perspective described it as investments that “are focused on ways to:

- appraise systems for their transformational potential;

- design portfolios that harness interconnections and amplify positive value flows;

- establish fit-for-purpose governance and sensing mechanisms;

- and allocate and manage resources adaptively as change happens.” (iv)

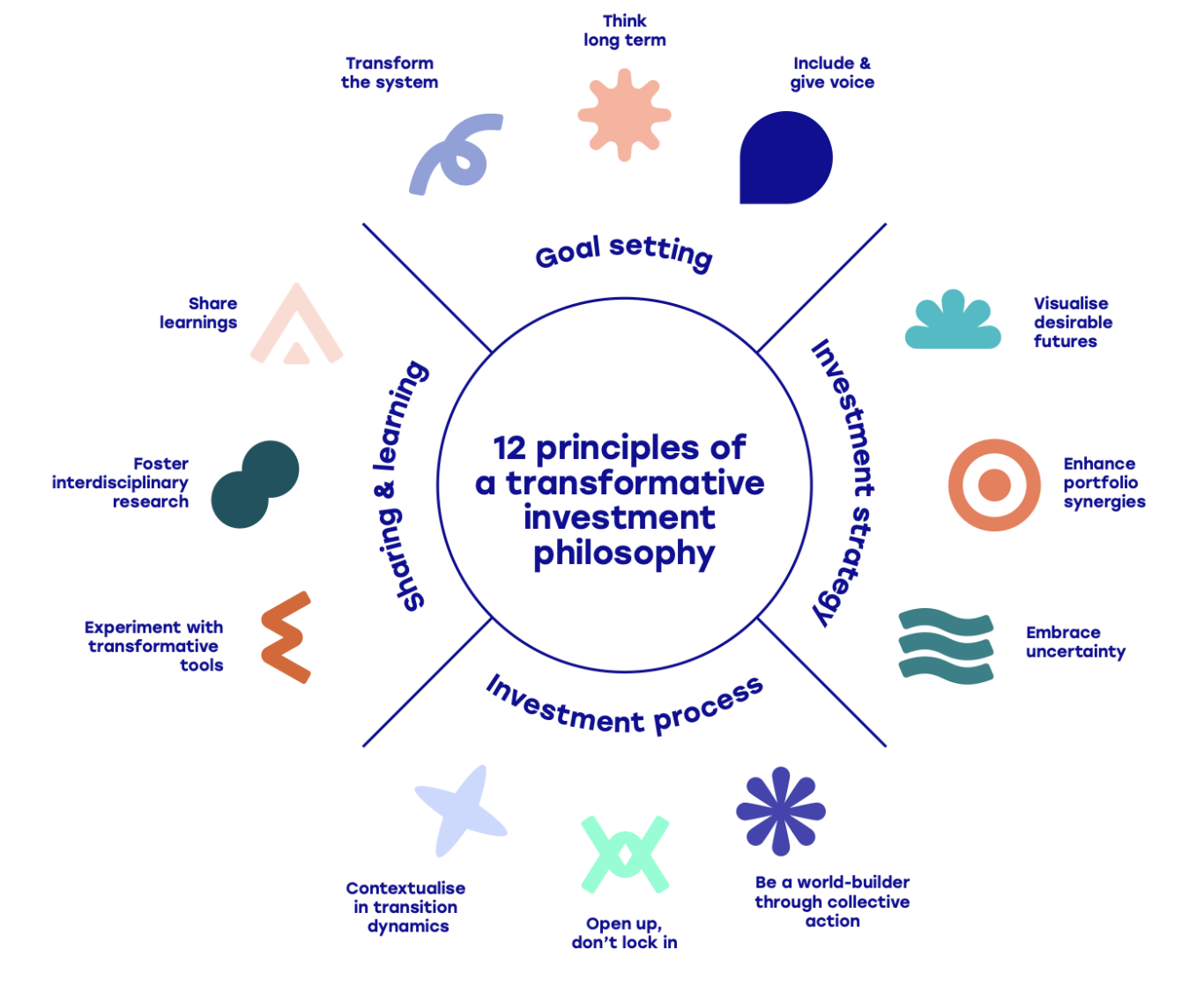

Another leading work (v) identified three implications of moving from conventional to “transformative investment” approach:

- Shift the perspective to the transformative potential of investments;

- Identify intervention points in single and multiple systems to stretch the transformative potential of investments;

- Collaborate to transform.

It also identified 12 Principles of a Transformative Investment Philosophy, presented below:

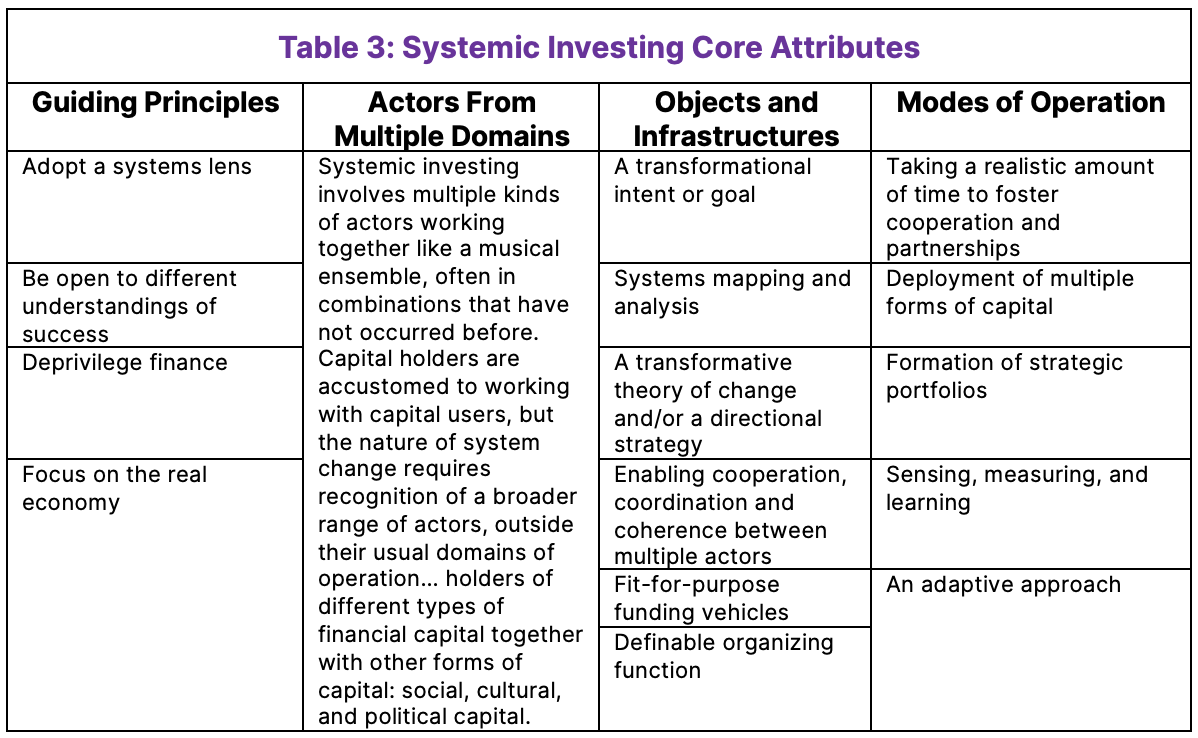

A 2023 article defines systemic investing in terms of guiding principles, actors from multiple domains, objects and infrastructures, and modes of operation. These are presented below (vi):

References:

[i] https://transformation.capital. Accessed Jan. 5, 2024

[ii] Daggers, Jess, Alex Hannant, and Jason Jay. “Systemic Investing for Social Change.” Stanford Social Innovation Review, December 12, 2023. https://ssir.org/articles/entry/systemic_investing_for_social_change.

[iii] Waddell, Steve. “An Investigation into Financing Transformation.” https://catalyst2030.net/project_category/catalyst-2030-reports/: Catalyst2030 Bounce Beyond Cattail Strategy, 2021.

[iv] Hannant, A., I. Burkett, E. Fowler, T. O’Brien, J. McNeill, and A. Price. “Design Foundations for Systems Capital.” Yunus Centre Griffith University, Hatched, 2022.

[v] Schot, Johan, Roberta Benedetti del Rio, Ed Steinmueller, and Susanne Keesman. “Transformative Investment In Sustainability: An Investment Philosophy for the Second Deep Transition.” Deep Transitions, November 16, 2022. https://www.transformativeinvestment.net/#.

[vi] Daggers, Jess, Alex Hannant, and Jason Jay. “Systemic Investing for Social Change.” Stanford Social Innovation Review, December 12, 2023. https://ssir.org/articles/entry/systemic_investing_for_social_change.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.